Mergers and Acquisitions Toolkit includes all the Frameworks, Best Practices & Templates required to improve the M&A capability of your organization and boost your personal career.

What’s inside Mergers and Acquisitions Toolkit?

This Toolkit includes frameworks, tools, templates, tutorials, real-life examples, best practices, and video training to help you:

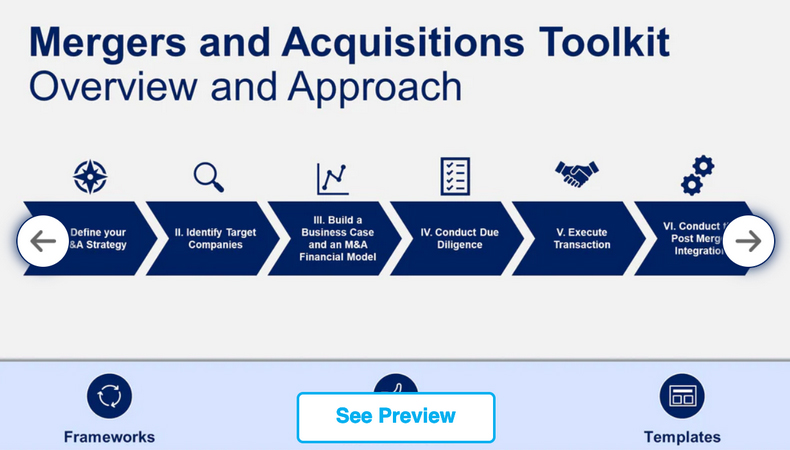

Improve the M&A capability of your organization and boost your personal career with our 7-phase approach:

(I) Define your M&A Strategy, (II) Identify Target Companies, (III) Build a Business Case and Financial Model, (IV) Conduct a Due Diligence, (V) Execute Transaction, (VI) Conduct the Post Merger Integration, (VII) Activities specific to Carve-outs

- Define your M&A Strategy: (1) Company mission, vision and values, (2) M&A key considerations, (3) M&A strategic objectives and key performance indicators, (4) M&A team, (5) M&A guiding principles, (6) Target screening criteria, (7) Current M&A pipeline

- Identify Target Companies: (1) Potential target companies and data collection, (2) High-level assessment of potential target companies, (3) Shortlisted potential targets, (4) Financial statements analysis, (5) Valuation: DCF model, comparable company analysis, and precedent transaction analysis, (6) Targets approved for the business case phase

- Build a Business Case and Financial Model: (1) Strategic benefit, (2) Feasibility, (3) Financial benefit, (4) Comprehensive M&A financial model including acquirer model, target model, merger assumptions & analysis, and pro forma model, (5) Simple Financial model including integration cost, revenue synergy, cost synergy, NPV, ROI, and IRR, (6) Letter of intent or term sheet

- Conduct a Due Diligence: (1) Data room and clean room, (2) Work plan including key business case hypotheses & assumptions, (3) Due diligence to validate key hypotheses and assumptions, (4) Updated valuation, business case, and financial model, (5) Recommendation to make (or not) a formal offer to acquire the target company

- Execute Transaction: (1) Deal structure, (2) Sale and purchase agreement (SPA), (3) M&A negotiations, (4) Signing and closing the M&A deal

- Conduct the Post Merger Integration: (1) Integration strategy, (2) Integration & synergy initiatives, (3) Detailed Plans, (4) Implementation & Monitoring, (5) Change Management and Internal Communication, (6) Stakeholder Engagement

- Activities specific to Carve-outs: (1) Exit readiness, (2) Transaction perimeter , (3) Separation concepts, (4) Management presentation, (5) Legal entity, (6) Separation execution

Name of Course: Domont Consulting – Mergers and Acquisitions Toolkit | Release Date: 2023

Sale Page: https://www.domontconsulting.com/products/mergers-and-acquisitions-toolkit/

Author Price: $1997 | Our Price: FREE FOR VIP MEMBERS

Delivery Method: Free Download (Mega)

Download link hidden, please LOGIN or PURCHASE A MEMBERSHIP to view.